An analysis of network filtering methods to sovereign bond yields during COVID-19

Abstract

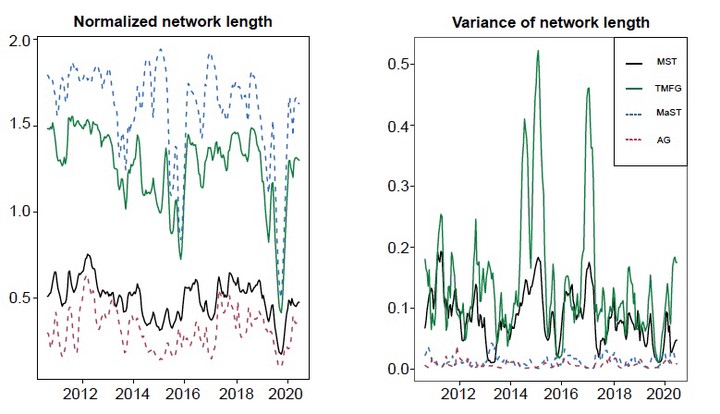

In this work, we investigate the impact of the COVID-19 pandemic on sovereign bond yields amongst European countries. We consider the temporal changes from financial correlations using network filtering methods. These methods consider a subset of links within the correlation matrix, which gives rise to a network structure. We use sovereign bond yield data from 17 European countries between the 2010 and 2020 period as an indicator of the economic health of countries. We find that the average correlation between sovereign bonds within the COVID-19 period decreases, from the peak observed in the 2019-2020 period, where this trend is also reflected in all network filtering methods. We also find variations between the movements of different network filtering methods under various network measures.